I’ve often felt that homeownership is not the rosy American Dream that it claims to be. I find homeownership limiting, both economically and geographically: my parents and their friends, and now friends my own age, seem to sacrifice anything and everything in order to make mortgage payments. The years I worked at Canada Mortgage and Housing Corporation, taught me how the federal housing agency was created partly to help sell the idea of homeownership right after WWII and enable it through a series of government-backed programs and policies. Then there’s my own research in the area of immigrant settlement and housing choice, which included a serious look at Canadian federal housing policies that have slowly eroded rental housing, co-op housing and social housing as options while supporting homeownership through numerous incentives. Let’s just say that it’s no surprise that at age 36, I’m still a renter, bucking the DINK and yuppie trends, a little cynical about the myth that renting is just “throwing your money away.” After all, renting has allowed me to remain flexible, pick up and move to different cities, travel, and live in neighbourhoods I never could have afforded if I had bought.

It appears that Richard Florida agrees with me. Higher rates of renting, public transit use and residential mobility are all key themes in Florida’s latest book, The Great Reset: How New Ways of Living and Working Drive Post-Crash Prosperity, released two weeks ago (read a review of the book, and other Florida works and quirks, on Urbanophile). Florida belies the myth that housing is a good investment, particularly when it’s held for 20 or 30 years: the rate of return on housing in the US has generally been quite low, in fact from 1890 to 1990 it was exactly zero. We’ve all seen how difficult it can be to sell a house in recent years in the US, and in earlier recessionary times in Canada: my parents’ current house was bought for $20,000 less than a similar house a few blocks away because the owner had lost her job in the 1990s recession and had to sell quickly. A friend’s parents sold their house in 2007 for almost the same price they paid for it in the early 1980s because the mill in their town had closed, leaving most of the residents out of work.

Overinvestment in housing has decreased investment in other areas like medical technology, software and alternative energy. Florida has written before about the dangers of putting too many eggs in one basket: at the height of the mortgage crisis in the US (in a November 28, 2009 article in the Globe and Mail), he wrote that the mortgage system was directly responsible for the crisis, and that the era of overinvestment in homeownership and car ownership were over. Interestingly, Florida also applies his argument to individuals: Canadians carry more mortgage debt as a percentage of their disposable income than Americans, meaning we have far less to spend on other things. A friend of mine who works in mutual funds and investments tells me the average homeowner pays for their house two and a half times due to interest. This is probably no surprise to those of us living in the country’s biggest cities, where housing prices are astonomical and have not shown any decline in growth since the US mortgage crisis. In fact, housing prices in Canada increased 20% last year.

Florida argues that in cities with higher homeownership, unemployment is also higher because homeowners are less likely to pick up and move when things get tough. He believes that mobility is often the key to employment, and more flexible housing choices are key in times of economic instability. It seems there are other people out there like me, who prefer the flexibility of renting because we want to remain mobile and have no desire to live in one place for twenty years. We aren’t all that uncommon either: 40.1% of the Canadian population moved within the past five years, according to the 2006 Census; 14.1% moved within the last year. Florida correctly predicted that rental housing would play a major role in stabilizing the US economy after the mortgage crisis: families were able to move into foreclosed properties that were renovated and re-marketed as affordable rental housing. This was because the Obama administration wasted no time in investing $4.25 billion on the creation of tens of thousands of federally-subsidized rental units using the federal Making Homes Affordable program.

In his May 3rd article in the Globe and Mail, Florida goes as far as saying that “home ownership is an impediment to Canada’s long-term prosperity” because high house prices, low interest rates and lax government policies in Canada could spell trouble for the housing market. Even though people have been talking about the “bubble” for over fifteen years, Edward Jones’ recent report predicts Canada’s is about to burst. The federal government recently made it more difficult to get a mortgage and is considering other measures to tighten mortgage availability in order to protect the market from collapse. They eliminated the no down payment mortgage option before the US crisis began, but there is still a 5% down option. What is particularly interesting to me as a non-economist is how the housing market has historically been used to maintain or even increase consumer spending to stave off or recover from economic recession: besides the post-war era, we saw low interest rates brought in after the 1989 stock market crash in Canada and after 9/11 in the US to encourage people to keep buying homes. I guess there’s a fine line between “removing barriers to homeownership” to encourage spending and bringing on an economic meltdown by letting anyone with a a couple of bucks buy a house.

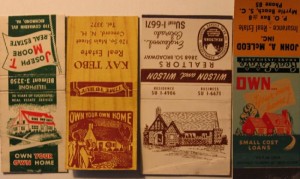

Massive marketing was required to sell the idea of homeownership as a stable, more respectable lifestyle choice. Let’s not forget that those first homes were practically given away at very low prices and low mortgage rates, their construction highly subsidized by federal governments in both the US and Canada. Those cherubic children, war brides and returning vets in 1940s suburban home ads were so convincing that most of us still believe homeowners are somehow better than renters: even Florida hints that switching from homeownership to renting might have “unforseen social costs” for cities and regions. Our own values and biases about homeownership drive the market. Yet a mere 60 years ago, renter households were the majority in both our countries.

The classic French text Un chez-moi à mon coût (2000) (edited by Eric Brassard), which I read at the urging of a fellow renter working at CMHC, carefully dissects all the economic myths of homeownership, arguing that it is often the non-economic factors that are the most influential. The book presents case studies of housing choices of a variety of professionals, both renters and owners, who argue that there is no sound economic argument for homeownership or against renting: it just comes down to personal preference. But we’re so invested in the homeownership ideal that investing in rental housing, or convincing middle-income families to rent, would take a lot of work. The tide may be turning in the US, but with high housing prices and fairly easy access to mortgages, we may not see this shift in Canada until our own mortgage crisis rears its ugly head.